W-2

You are finally employed and “making the big bucks” (anything is big compared to nothing). But with great power comes great responsibility: taxes. At the end of the year you will need to file and pay income taxes. And employees can't do that without a “W-2” form, which will be sent to both you and the IRS in February.

This form contains a year-end summary of your compensation and benefits as it relates to taxation. Whether you complete your taxes yourself, or hire a tax preparer, it is critical to know your way around your W-2.

Understanding your W-2 is necessary for understanding your taxes, applying for income-driven loan repayment plans, verifying your future social security benefits, and many other financial-related issues.

Many "side jobs" or moonlighting positions will report your income on a “1099-NEC”, which will explained on another section of this site at some point.

The W-2 Curbside Consult

As with all curbside consults, you rely on this information at your own risk because it does not account for all situations, and there are several exceptions and "asterisks" to this summarized information!

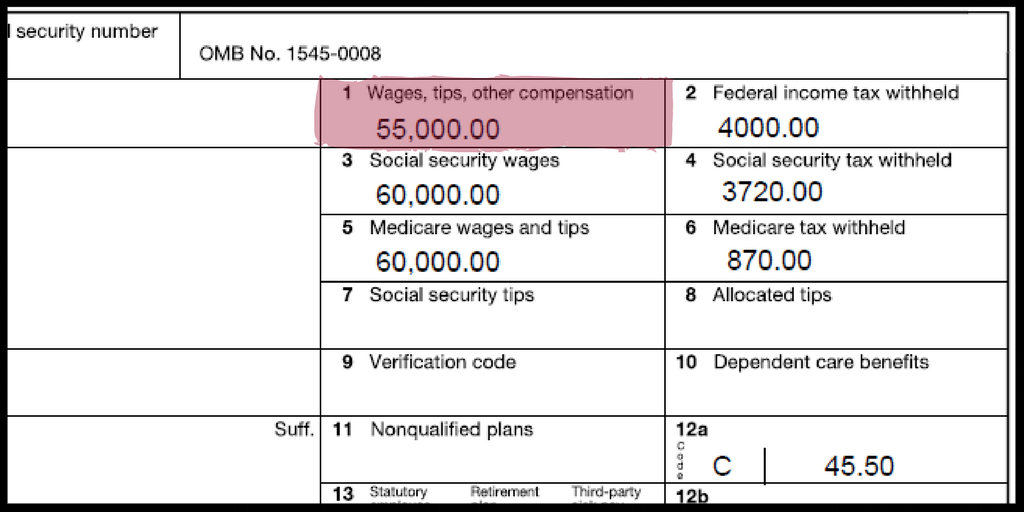

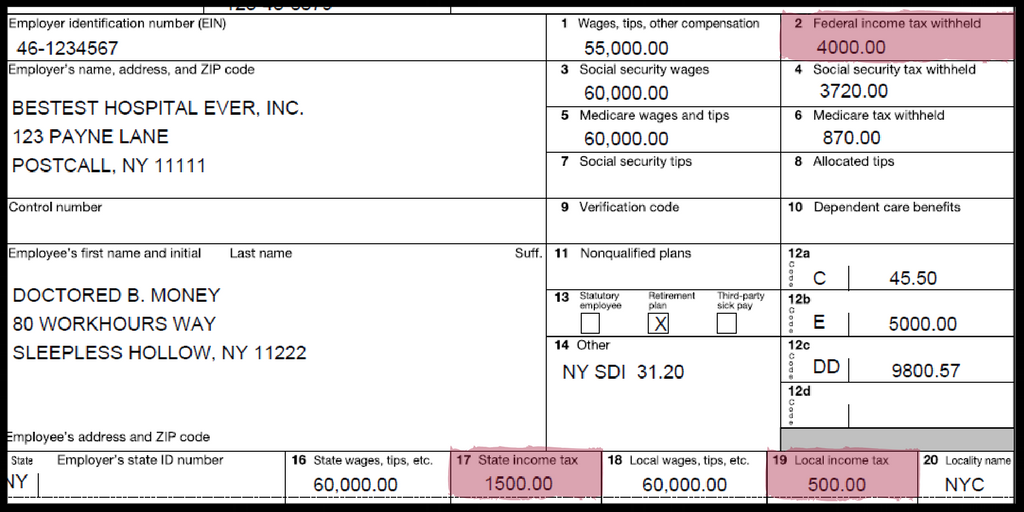

Here is your 90-second guide to the most important parts of your W-2. Look at one of your own W-2s, or follow along with the sample copy to the right (click to expand the sample, and be sure to read the caption). Continue past this "Curbside" for detailed line-by-line info, as well as a FAQ section at the bottom of the page. The current W2 is essentially identical to the 2017 form used for the reference photo.

Box 1

“Wages, tips, other compensation”

This is the amount that will ultimately get transported to your main tax form (Form 1040, line 7). Box 1 represents your total compensation, minus certain tax-deductible items taken out of your paycheck.

These commonly include health insurance premiums, non-Roth 401k/403b/457b contributions, commuter/parking benefit deductions, flexible health or dependent care account contributions, and employee health savings account contributions.

In general: (Box 1) + (deductible retirement account contributions) = (Box 5).

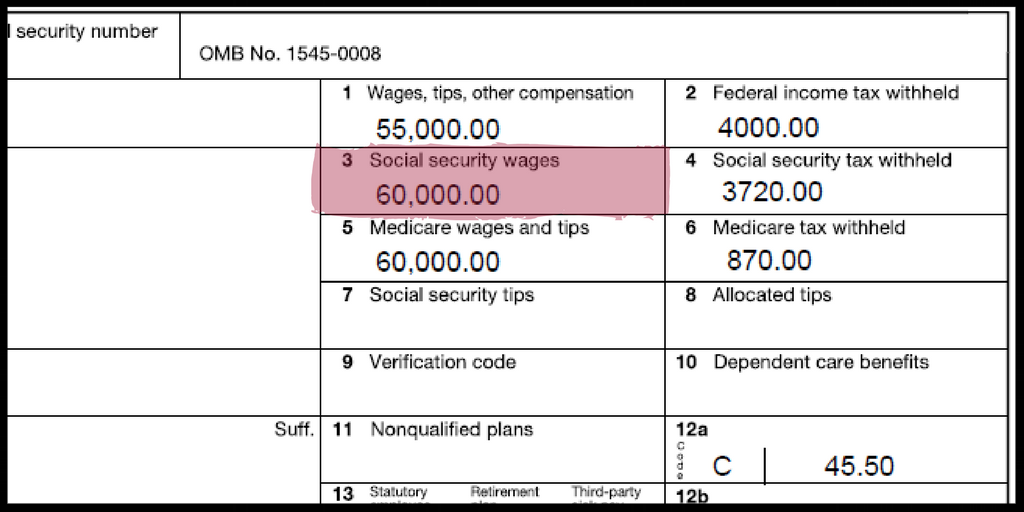

Box 3

“Social Security Wages”

The amount of your compensation up to the “Benefit and Contribution Base” (more commonly referred to as the “Social Security Wage Base” (SSWB), is taxed at 6.2%. For 2022, the SSWB is $147,000 ($160,200 for 2023). The total Social Security tax paid on Box 3 is listed in Box 4.

Tax-deductible retirement account contributions are NOT deductible from your Social Security Wages, and thus ARE subject to SS tax (but are NOT subject to income taxes, which is why they don't appear in Box 1).

However health insurance premiums, commuter/parking benefit deductions, flexible health or dependent care account contributions, and employee health savings account contributions are NOT subject to SS tax (nor income tax or Medicare tax) and are excluded from this box (as well as excluded from Boxes 1 and 5).

Box 5

“Medicare wages and tips”

All of your compensation (minus the excluded items listed for Box 3) is subject to Medicare tax (1.45%) without limit. Box 6 is your total Medicare tax. Box 5 should equal Box 3 if it is less than the SSWB.

Boxes

2, 17, and 19

The amount of federal, state and local taxes withheld from your pay.

Boxes 16 and 18

These represent the amount of wages taxed at the state and local level. This is usually equal to Box 1, because items which are tax deductible at the federal level are typically also deductible at the state level (with some exceptions depending on the state). Note in this example that Boxes 16 and 18 do NOT equal Box 1, which is a mistake.

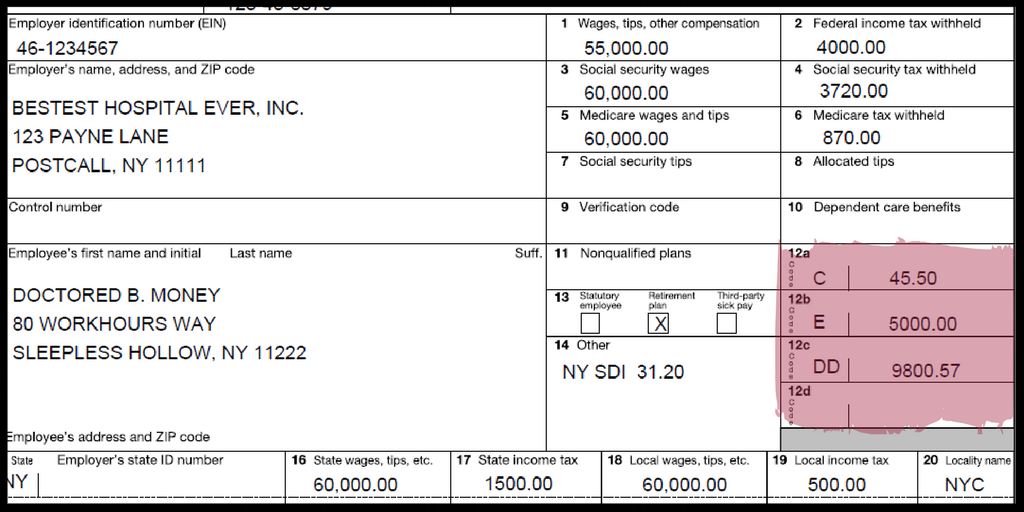

Box 12-12d

There are several possible codes here which describe the amount listed. Some of the more common ones are: C - (taxable amount of life insurance provided to you); D or E - (tax deductible retirement account contributions, already excluded from your wages in Box 1); AA or BB - (non-deductible Roth contributions to an employer account); DD – (your employer’s share of health insurance premiums, which is not taxable to you and is just an "fyi"); W - health savings account contributions (already excluded from Boxes 1, 3, and 5).

Going Beyond

the Basics

If you have read this far, good for you! We'd be willing to bet that you were one of those students who read those "historical information" boxes in the margins of your biochemistry text book (e.g. "Linus Pauling, The Early Years") even though you knew it would not be on your exam. Or, you have ADHD and couldn't help but read them.

Either way, keep reading for some additional Box-by-Box information not covered by the Curbside Consult above.

The W-2 is the main form your employer uses to communicate your pay and tax information to both you and the IRS. By law, employers are supposed to mail those out to you (or provide an online copy) by Jan 31st.

Some boxes, such as your taxable wages and income tax withheld, contain information without which you cannot compute your tax due. Other boxes may simply be informational. Feel free to read the official instructions for form W-2 which are meant for your employer but will cover any situation not explained on this page. Here are some additional W-2 details, as well as a FAQ-like section further below.

A lot of information on the form is self explanatory, such as your SS#, your address, your employer's name and address, your employer's federal ID number. The "control number" is an optional box for your employer's reference.

Box 1

This represents your taxable wages/salary or compensation.

It's important to remember that amounts contributed to deductible retirement accounts, health insurance premiums you pay, flexible health or dependent care account contributions, and employee health savings account contributions are deducted from your salary prior to going into box 1. Thus, Box 1 is usually less than your total compensation.

But certain items can also be added to Box 1 in addition to your salary. One common example is a bonus (which is obviously taxable compensation).

Note that moving expenses used to be tax-deductible. If your employer gives reimburses you for moving expenses, that’s taxable just like any other salary or wages.

For those on an income-driven student loan repayment plan, remember that the amount in Box 1 is one component of your “Adjusted Gross Income” (as determined by line 37 of your form 1040 when you file your taxes). Thus, anything which reduces your Box 1 wages will have the effect of lowering your AGI, and ultimately the amount of your student loan payments.

Box 2

This is the amount of federal tax withheld from your paychecks. Remember that it is you which determines how much your employer withholds, based on information you put on your W-4. Thus Box 2 may or may not be close to the total tax you are ultimately required to pay when you file your taxes.

Box 3

Wages are subject to payroll taxes (which are officially called “Federal Insurance Contribution Act” taxes or “FICA”). The two payroll taxes are the Social Security tax, and the Medicare tax.

Box 3 represents the amount of your compensation which is subject to Social Security tax. You pay 6.2% tax on your wages, but up to a maximum of $160,200 for 2023 (which increases in most years according to set rules). This maximum is officially called the “Benefit and Contribution Base”. However, more commonly used unofficial synonyms are the Social Security Wage Base (SSWB) or sometimes just the “Social Security maximum”.

There are two equal contributions for each payroll tax: the employer contribution and the employee contribution. Box 3 represents the employee share (i.e. your share) of the Social Security tax. The employer contribution is identical and is not reflected on the W-2.

Note that those who are self-employed are simultaneously the employer and employee. Thus, a self-employed individual pays “both halves” of the SS tax for a total of 12.4% (up to the SSWB). Moonlighting physicians are commonly considered self-employed, and thus are responsible for a higher proportion of tax on moonlighting profits when compared to their regular salary.

Box 4

This is simply the total amount of Social Security tax paid on your wages. The maximum amount for 2023 for employees is $9932.40 (i.e. 6.2% x $160,200).

Box 5

This is the amount of wages subject to the second set of payroll taxes, which is the Medicare tax. Like the SS tax, there is an equal employer contribution and and an employee contribution. Your share is 1.45%. But unlike the SS tax, there is no limit on the amount subject to tax.

As with the Social Security tax, moonlighters (i.e. those with self-employment income) pay both halves of the Medicare tax.

Note that with the passage of the Affordable Care Act, there is an additional Medicare tax of 0.9% for wages above $200,000 (single) or $250,000 (married filing jointly). Employers are required to withhold an extra 0.9% Medicare tax on W-2 wages which exceed $200,000.

However, depending on your marital status and other jobs, if any (yours or your spouse's), the extra Medicare tax may not reflect your actual obligation. Thus you may owe even more "Additional Medicare Tax" when you file, or you may be due a refund of excess Medicare tax. This gets determined on your 1040 (after filling out the extra from 8959). See here for more information on the Additional Medicare Tax.

Special Note Boxes 1, 3, 5

None of these boxes may actually reflect your true compensation. For example contributions to a health savings account, a commuter benefit plan, and your share of health insurance premiums are not subject to income tax or payroll taxes and will not appear in Boxes 1, 3, or 5.

In addition, deductible contributions to an employer retirement account (e.g. 401k, 403b, 457b, etc.) are not subject to income tax and thus do not appear in Box 1.

Note that retirement account contributions are not deducted from Social Security and Medicare wages. In general, Box 3 will equal Box 5 if you are under the SSWB, and Box 1 will be less than Boxes 3 and 5 by the amount of any non-Roth 401k/403b contributions.

Box 6

This is simply the amount of Medicare tax withheld during the year.

Boxes 7 and 8

This is related to tip income and won’t be discussed here. See the W-2 instructions for these boxes if you are curious.

Box 9

This box started in 2017 as a “verification code” to test anti-identity theft measures and was discontinued in 2019. For finance geeks like us, interesting additional information is here.

Box 10

Contributions to your employer’s flexible dependent care account are reported here, and are excluded from your reportable wages (Boxes 1, 3, 5) up to $5000 as long as you are not married filing separately .

The amount in Box 10 ends up on line 12 of Form 2441, which is the form used to determine whether your dependent care account contributions are tax free (e.g. if you have at least as much qualifying expenses as you have made contributions).

In certain rare cases, you may also be eligible for a small child tax credit as calculated by Form 2441, although those who maximize their dependent care deductions will not qualify for the credit.

Box 11

Few people will have anything here. It is typically used to report distributions from a “non-qualified” plan, which are most commonly “non-governmental” 457b plans.

These distributions get taxed as wages, but FICA (Social Security and Medicare) tax have been paid in a previous year so are not charged again. Thus, amounts in this box are included in Box 1 as wages, but not Boxes 3 or 5.

Box 12

This is a catch-all box for several possible amounts, each associated with a “code”. Common codes are listed above in the Curbside. For a complete list of codes, start at page 18 of the IRS instructions for the W2.

Box 13

For the vast majority, only the checkbox “Retirement plan” applies, which designates if you or your employer made any contributions to an employer retirement plan such as a 401k or 403b. This is important because your ability to deduct IRA contributions can be limited if you “participated” in an employee retirement plan.

Box 14

Lots of things can go here, most commonly the amount of state disability insurance you are obligated to pay.

The IRS instructions for form W-2 state: "You also may use this box for any other information that you want to give to your employee. Label each item. Examples include state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted, nontaxable income, educational assistance payments, or a minister's parsonage allowance and utilities. In addition, you may enter the following contributions to a pension plan: (a) nonelective employer contributions made on behalf of an employee, (b) voluntary after-tax contributions (but not designated Roth contributions) that are deducted from an employee's pay, (c) required employee contributions, and (d) employer matching contributions."

Boxes 15 - 20

The amounts of state and local (i.e. city or county) taxes withheld are listed here.

Form W-2 FAQ

My W-2 is incorrect. What should I do?

In general, your employer needs to correct the W-2 and issue you a W-2c (c=corrected) before you can file. Talk to your employer directly via HR or payroll department to work it out.

If the correction is delayed, it might be necessary to file an extension on your taxes and wait to officially file when the correction is received. See here if your employer cannot or will not correct the W-2.

Why do I have so many duplicate copies of the W-2 forms from the same job?

In the days of paper filing, you would submit a copy of the W-2 to the IRS, as well as to each state you filed taxes with. So you received a minimum of 3 copies (IRS, State, one for your records).

If you have income listed on the W-2 from multiple states, you get yet another copy for the additional states. Look at the bottom of each W-2 and you'll see the terms "Copy 1", "Copy C", "Copy 2", etc. along with a description of the purpose of that copy.

Now that most people e-file, these copies are redundant. Note however, that if you had withholding from the same employer from more than 2 localities, there may be information on one copy which is NOT on the main copy. So don't miss this when preparing your taxes. You'll need to aggregate the info for use on your 1040 or 1040 schedule A.

My employer paid for my moving expenses. Is this taxable, and does it appear on my W-2?

As of the new 2018 tax law, moving expenses are no longer tax deductible. And moving expenses paid by your employer on your behalf (whether through reimbursement or directly to a third party) are now taxable to you as wages.